Turning your money over to a financial institution for safekeeping is a crucial aspect of financial management, offering peace of mind and protection against potential risks. This article delves into the concept of safekeeping services, examining their purpose, benefits, and the factors to consider when choosing a financial institution for such services.

Understanding the different types of safekeeping services, such as cash deposit accounts, certificates of deposit, and safe deposit boxes, is essential for making informed decisions. Additionally, it is important to be aware of the potential risks associated with safekeeping, including loss or theft, inflation, and financial institution failure, and to implement appropriate mitigation strategies.

Understanding Safekeeping Services

Turning over money to a financial institution for safekeeping involves entrusting a trusted entity with the responsibility of safeguarding your funds. These services provide a secure and convenient way to store your money, protecting it from loss, theft, or unauthorized access.

Safekeeping services offer numerous benefits, including peace of mind, reduced risk of financial loss, and potential returns on investment through interest earned on deposited funds.

Types of Safekeeping Services

Financial institutions offer various types of safekeeping services tailored to different needs and preferences. Some common options include:

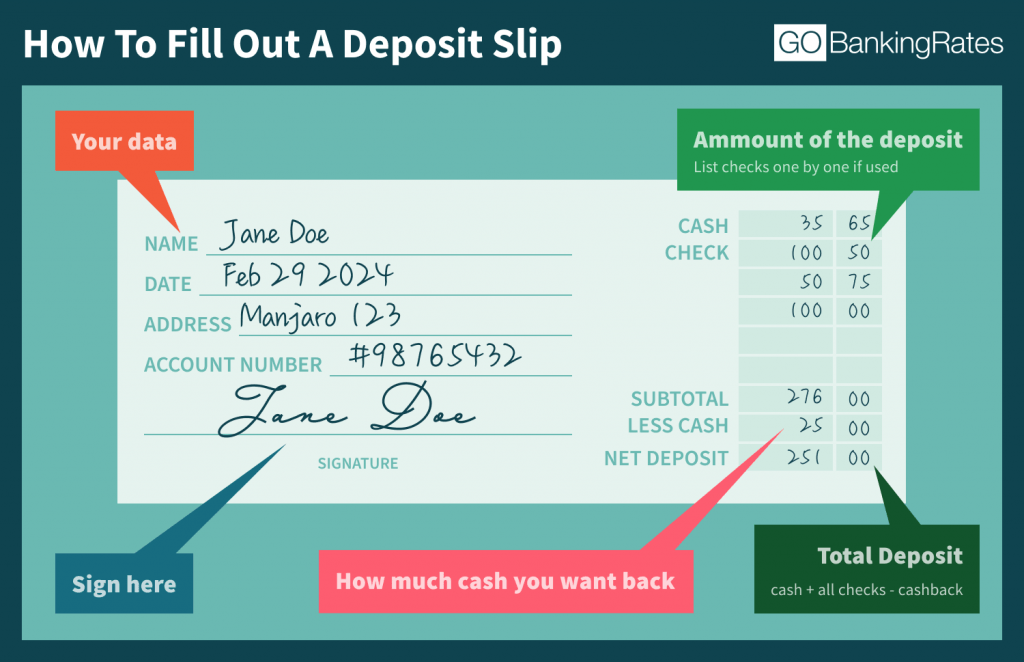

- Cash deposit accounts:These accounts allow you to deposit and withdraw cash as needed, while earning interest on your balance.

- Certificates of deposit (CDs):CDs offer fixed interest rates for a specified period, providing a guaranteed return on investment.

- Money market accounts:These accounts combine the features of checking and savings accounts, offering check-writing capabilities and competitive interest rates.

- Safe deposit boxes:These secure boxes provide physical storage for valuables such as jewelry, important documents, and cash.

Factors to Consider When Choosing a Financial Institution

When selecting a financial institution for safekeeping services, it’s essential to consider several key factors:

- Reputation and financial stability:Choose an institution with a strong reputation and a proven track record of financial stability.

- Interest rates and fees:Compare interest rates and fees charged by different institutions to ensure you’re getting the best deal.

- Accessibility and convenience:Consider the accessibility of the institution’s branches and ATMs, as well as their online and mobile banking services.

Risks and Mitigation Strategies

While safekeeping services offer numerous benefits, there are potential risks to consider:

- Loss or theft:Funds deposited in a financial institution may be lost or stolen due to fraud, hacking, or other unforeseen events.

- Inflation:The value of money can decrease over time due to inflation, eroding the purchasing power of your savings.

- Financial institution failure:In rare cases, financial institutions may fail, potentially resulting in the loss of your funds.

To mitigate these risks, consider the following strategies:

- Choose a reputable institution with strong security measures.

- Diversify your investments by using multiple financial institutions.

- Consider investing in inflation-protected assets such as Treasury Inflation-Protected Securities (TIPS).

- Monitor your account statements regularly and report any unauthorized activity immediately.

Alternatives to Safekeeping Services

In addition to safekeeping services offered by financial institutions, there are alternative options for keeping money safe:

- Home safes:These safes provide a physical barrier against theft, but they may not be as secure as bank vaults.

- Physical gold or silver:Precious metals can serve as a hedge against inflation and financial instability, but they can be difficult to store and transport securely.

- Cryptocurrency wallets:Cryptocurrency wallets allow you to store and manage digital currencies, providing a high level of security through encryption and blockchain technology.

FAQ Explained: Turning Your Money Over To A Financial Institution For Safekeeping

What are the key benefits of using safekeeping services?

Safekeeping services provide numerous benefits, including protection against loss or theft, insurance against financial institution failure, and convenient access to funds when needed.

What factors should be considered when selecting a financial institution for safekeeping services?

When choosing a financial institution for safekeeping services, it is important to consider factors such as reputation and financial stability, interest rates and fees, and accessibility and convenience.

What are some alternative options for keeping money safe besides safekeeping services?

Alternative options for keeping money safe include home safes, physical gold or silver, and cryptocurrency wallets. However, it is important to note that these options may not offer the same level of security and convenience as safekeeping services provided by financial institutions.