As the accounting principle of “all payments less than $25 are expensed as incurred” takes center stage, this exploration delves into its rationale, implications, and alternative approaches. Understanding this concept empowers businesses to optimize their financial reporting practices, ensuring accuracy, transparency, and informed decision-making.

The practice of expensing small payments as incurred aligns with the matching principle, ensuring expenses are recognized in the same period as the associated revenues. This approach simplifies accounting procedures, reduces the risk of errors, and provides a clearer picture of a company’s financial performance.

Definition of Expenses

Expenses are costs incurred by a business in the process of generating revenue. They are recorded on the income statement and are deducted from revenue to determine net income. Expenses can be classified into two main categories: operating expenses and capital expenditures.

Operating expenses are costs incurred in the day-to-day operations of a business. These expenses are typically deducted from revenue in the period in which they are incurred. Examples of operating expenses include salaries, rent, utilities, and advertising.

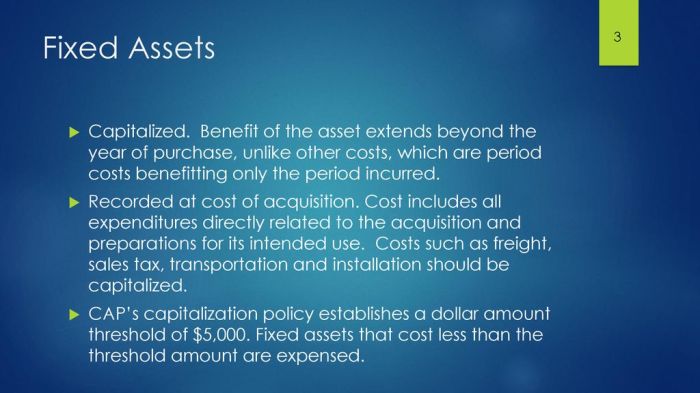

Capital expenditures are costs incurred to acquire or improve long-term assets. These assets are recorded on the balance sheet and are depreciated over their useful lives. Examples of capital expenditures include the purchase of equipment, buildings, and land.

Expense Recognition Principles

The matching principle is an accounting principle that states that expenses should be recognized in the same period as the revenue they generate. This principle ensures that the income statement accurately reflects the financial performance of a business for a given period.

There are two main methods of expense recognition: cash basis and accrual basis. Under the cash basis method, expenses are recognized when cash is paid. Under the accrual basis method, expenses are recognized when they are incurred, regardless of when cash is paid.

The choice of expense recognition method can have a significant impact on financial statements. For example, a business that uses the cash basis method will report lower expenses in periods when it has a large amount of unpaid bills. This can lead to a more favorable financial picture than a business that uses the accrual basis method.

Treatment of Payments Less Than $25

Many businesses expense payments less than $25 as incurred. This is because the cost of tracking and recording these payments would outweigh the benefit of doing so. In addition, the impact of these payments on the financial statements is typically immaterial.

There are several advantages to expensing payments less than $25 as incurred. First, it simplifies the accounting process. Second, it reduces the risk of error. Third, it can improve cash flow by allowing businesses to deduct these expenses immediately.

However, there are also some disadvantages to expensing payments less than $25 as incurred. First, it can lead to overstatement of expenses in the early years of a business’s life. Second, it can make it difficult to compare financial statements to other businesses that use different expense recognition methods.

Alternatives to Expensing Small Payments

There are several alternatives to expensing small payments as incurred. One alternative is to accumulate these payments until they reach a certain threshold. This threshold could be based on a dollar amount, a number of transactions, or a period of time.

Another alternative is to use a petty cash fund. A petty cash fund is a small amount of cash that is used to pay for small expenses. The petty cash fund is replenished on a regular basis.

The best approach for handling small payments will vary depending on the specific circumstances of the business.

Impact on Financial Reporting: All Payments Less Than Are Expensed As Incurred

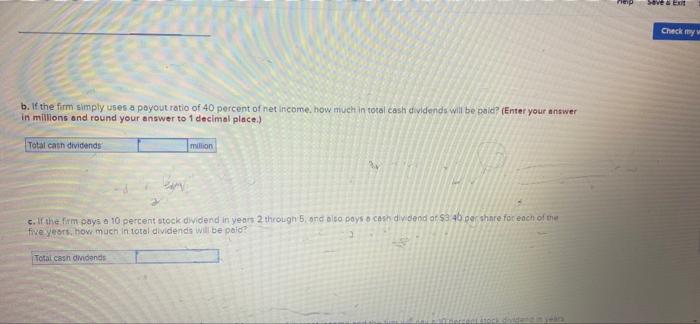

The treatment of payments less than $25 can have a significant impact on financial reporting. For example, a business that expenses these payments as incurred will report lower net income and higher expenses than a business that accumulates these payments until they reach a certain threshold.

The treatment of payments less than $25 can also affect financial ratios. For example, a business that expenses these payments as incurred will have a lower current ratio than a business that accumulates these payments until they reach a certain threshold.

It is important for businesses to be aware of the impact of the treatment of payments less than $25 on their financial reporting.

Audit Considerations

Auditors should be aware of the potential risks associated with the treatment of payments less than $ 25. These risks include:

- Overstatement of expenses

- Understatement of assets

- Misappropriation of funds

Auditors should perform the following procedures to verify the treatment of payments less than $25:

- Review the accounting policy for the treatment of small payments

- Test the cutoff for the expensing of small payments

- Examine supporting documentation for small payments

- Inquire about the use of petty cash funds

Expert Answers

What is the rationale behind expensing payments less than $25 as incurred?

This approach aligns with the matching principle, ensuring expenses are recognized in the same period as the associated revenues. It simplifies accounting procedures and provides a clearer picture of a company’s financial performance.

What are the advantages of expensing small payments as incurred?

This practice simplifies accounting processes, reduces the risk of errors, and enhances the accuracy of financial reporting.

Are there any alternative approaches to expensing small payments?

Yes, alternative methods include accumulating small payments until they reach a certain threshold or capitalizing them as assets. However, expensing small payments as incurred remains a widely accepted and effective practice.